Mr. Trump Concern Should Be Our Debt To DGP. Not Rate Cuts

MEMORANDUM

TO: The Honorable Donald J. Trump, President of the United States

FROM: Mr. J. Nixon Joseph, Chairman and President of JNJ & Associates llc

SUBJECT: Urgent: Strategic Focus on Debt Reduction and Economic Resilience

DATE: July 24, 2025

EXECUTIVE SUMMARY

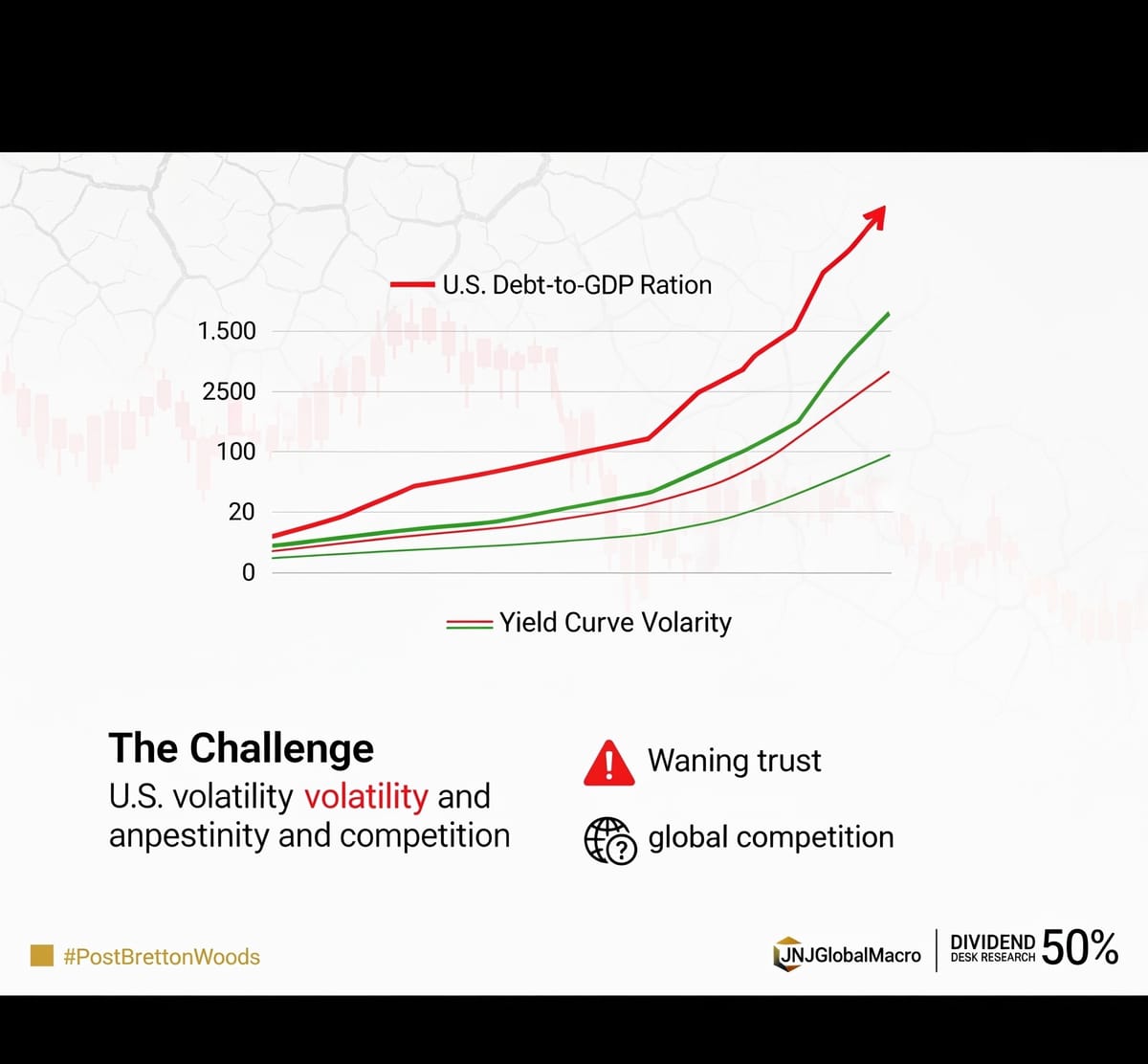

The United States faces pressing economic challenges that require immediate strategic action to ensure long-term stability and global competitiveness. The national debt exceeds $36.5 trillion, with a debt-to-GDP ratio of approximately 100% in 2024, projected to rise to 116% by 2034 per Congressional Budget Office (CBO) estimates. China’s economic slowdown, driven by a property market collapse and local government debt, threatens global trade dynamics and U.S. Treasury holdings. Tariffs, while impactful, risk diminishing returns due to market adjustments and retaliatory measures. This memo outlines actionable recommendations to address these issues and mitigate risks of fiscal instability and global market volatility.

KEY ISSUES

- Critical Debt Levels : The U.S. national debt stands at $36.56 trillion, with publicly held debt at $29 trillion and interest payments reaching $726 billion annually in 2023, surpassing Medicare and defense spending. The debt-to-GDP ratio, at 100% in 2024, is projected to climb to 116% by 2034, risking fiscal sustainability.

- China’s Economic Challenges: China’s economy faces a property market collapse, local government debt of up to **60 trillion yuan ($8.2 trillion)**, and declining consumer confidence. This could reduce China’s U.S. Treasury holdings ($759 billion as of December 2024), impacting global trade and U.S. financial markets.

- Tariff Limitations: Tariffs, such as the 50% on Brazilian exports and proposed increases on Chinese goods, face challenges from market adjustments and retaliatory measures, potentially reducing U.S. GDP growth by 0.6–1.0% in affected economies and disrupting U.S. trade.

RECOMMENDATIONS

- Prioritize Debt Reduction:

- Entitlement Reform: Implement gradual adjustments to Social Security and Medicare, such as raising the retirement age or means-testing benefits, to reduce the primary deficit by $200 billion annually within five years.

- Spending Review : Conduct a comprehensive audit of federal spending to identify inefficiencies, targeting a 10% reduction in discretionary spending ($150 billion annually) over five years.

- Revenue Enhancement: Extend select provisions of the 2017 Tax Cuts and Jobs Act expiring in 2025, offset by closing tax loopholes for high-income earners to generate $100 billion annually in additional revenue.

- Goal : Stabilize the debt-to-GDP ratio below 100% within a decade to mitigate fiscal risks.

- Diversify Economic Strategies:

- Trade Agreements: Pursue bilateral trade deals with allies (e.g., UK, Canada) to diversify export markets, aiming to increase U.S. exports by 5% annually and reduce reliance on tariff-driven policies.

- Domestic Investment: Allocate $500 billion over five years to infrastructure and advanced manufacturing through public-private partnerships, creating an estimated 1 million jobs and boosting GDP growth by 0.5% annually.

- Export Competitiveness. Offer tax incentives for small- and medium-sized enterprises to expand exports, targeting a 10% increase in non-tariff-based exports by 2030 to counter China’s trade disruptions.

CONSEQUENCES OF INACTION

- Fiscal Crisis Risk. Unchecked debt growth could drive interest payments to $1 trillion annually by 2030, crowding out private investment, increasing interest rates by 1–2% , and risking a fiscal crisis.

- Global Economic Volatility: China’s economic challenges and tariff-related disruptions could reduce U.S. exports by 10–15% in affected sectors, leading to a potential 0.5% annual GDP reduction and destabilizing global markets.

CONCLUSION

Immediate action to reduce the national debt and diversify economic strategies is critical to safeguarding U.S. economic security. By implementing targeted fiscal reforms and broadening trade policies, the administration can mitigate the risks posed by rising debt and global economic shifts, ensuring long-term prosperity.