Refined Proposal: Tokenized Blockchain Solution for U.S. National Debt Management

The White House, Federal Reserve, and U.S. Department of the Treasury

Date: August 22, 2025

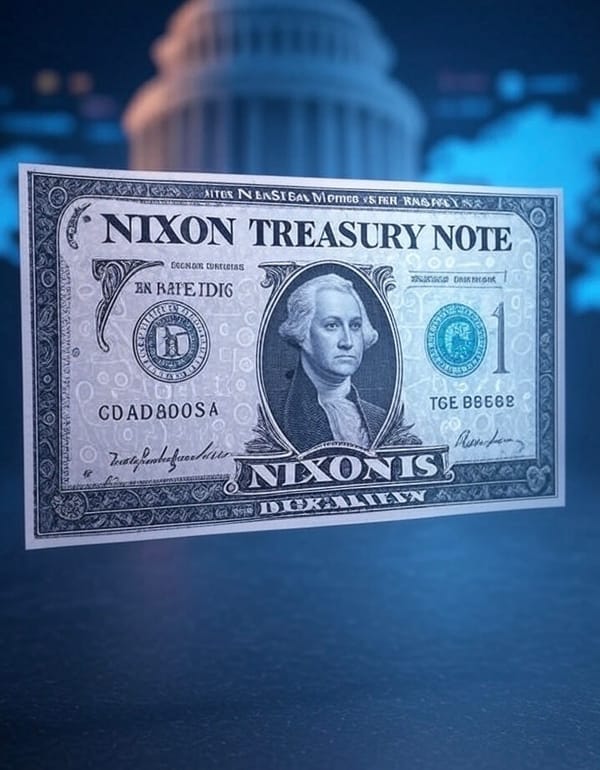

We propose a tokenized blockchain solution to modernize the management of the U.S. national debt, leveraging blockchain’s transparency, security, and efficiency. This initiative aims to enhance fiscal sustainability, reduce administrative costs, and strengthen investor confidence amid a national debt exceeding $33 trillion. By aligning with the Treasury’s leadership in financial system innovation and the Federal Reserve’s focus on financial stability, this proposal offers a forward-thinking approach to a pressing economic challenge.

Key Components

1. Tokenized Debt Instruments : Convert portions of the national debt (e.g., Treasury securities) into digital tokens tradable on a blockchain platform, enabling fractional ownership and broader investor access.

2. Blockchain-Based Debt Management : Implement a secure, scalable blockchain system to track debt ownership, automate interest and principal payments, and provide real-time transaction records.

3. Enhanced Transparency : Ensure an immutable, publicly auditable ledger to increase accountability and reduce fraud risks.

4. Streamlined Efficiency : Automate processes to minimize intermediary involvement, aligning with efforts to modernize financial regulation.

Benefits

1. Cost Reduction : Automation could save $2.4–5.4 billion annually in administrative costs (based on 20–30% efficiency gains), easing the fiscal burden.

2. Transparency : A tamper-proof ledger enhances public trust, supporting the Treasury’s mandate to safeguard financial integrity.

3. Investor Confidence : Broader access via tokenization may lower borrowing costs by 0.1–0.5%, potentially saving $33–165 billion annually in interest payments.

4. Fiscal Stability : Improved debt management could mitigate risks of future crises, aligning with the Federal Reserve’s stability goals.

Implementation Plan

1. Pilot Program (2026–2027) :

- Tokenize a $1 billion Treasury bond tranche on a permissioned blockchain (e.g., Hyperledger Fabric) with select institutional investors.

- Evaluate transaction efficiency, cost savings, and market response over 12 months.

2. Stakeholder Collaboration (2026–2028) :

- Engage the Treasury, Federal Reserve, SEC, and major financial institutions to ensure alignment with regulatory and stability objectives.

- Host interagency workshops to address technical and legal considerations.

3. Regulatory Framework (2027–2028) :

- Develop guidelines with the Treasury and SEC for tokenized debt, addressing securities classification, AML/KYC compliance, and investor protections.

- Seek Congressional input to integrate with existing financial laws.

Potential Impact

1. Economic Stability : Reduced borrowing costs and enhanced transparency could stabilize Treasury markets, supporting the dollar’s global status.

2. Investor Participation: Tokenization may attract $100–200 billion in new retail investment, broadening the investor base.

3. Long-Term Sustainability : Savings and efficiency gains could lower the debt-to-GDP ratio by 1–2% by 2030, reducing future fiscal pressures.

Addressing Concerns

- Scalability: A phased approach starting with a pilot mitigates risks of overloading existing infrastructure.

- Regulatory Hurdles : Collaboration with the Treasury and Federal Reserve ensures compliance with current laws and facilitates necessary adjustments.

- Market Risks : Initial restrictions on secondary trading and real-time monitoring will minimize volatility.

- Cybersecurity : Robust encryption and regular audits will protect against breaches, aligning with national security priorities.

Recommendations

1. Task Force Formation : Establish a joint task force by Q1 2026, including representatives from the White House, Treasury, Federal Reserve, and private sector experts, to oversee feasibility and implementation.

2. Feasibility Study : Commission a study by Q3 2026 to assess technical viability, cost-benefit ratios, and regulatory needs, leveraging existing blockchain precedents (e.g., World Bank bond issuance).

3. Roadmap Development : Create a 2026–2030 roadmap with milestones (e.g., pilot launch by Q1 2028, 10% debt tokenized by 2029) and KPIs (e.g., 20% cost reduction, 90% system uptime).

Conclusion

This tokenized blockchain solution offers a transformative approach to managing the U.S. national debt, aligning with the White House’s economic growth agenda, the Federal Reserve’s stability mandate, and the Treasury’s innovation leadership. We propose an initial meeting with key stakeholders by Q4 2025 to discuss next steps and secure support. This initiative could position the U.S. as a global leader in financial technology while addressing the urgent need for fiscal reform.