Stablecoins vs. Currencies: What Investors Need to Know

As digital payments surge, terms like "stablecoins" and "currencies" are often confused. Understanding their differences is critical for navigating the evolving digital economy. This article breaks down stablecoins vs. currencies, their mechanics, risks, and why this distinction matters for investors.

What is a Currency?

A currency is a government-backed medium of exchange, unit of account, and store of value. Examples include the US Dollar (USD), Euro (EUR), and Japanese Yen (JPY). Issued by central banks, currencies are widely accepted, heavily regulated, and backed by sovereign trust.

What is a Stablecoin?

Stablecoins are cryptocurrencies designed to maintain stable value, typically pegged to assets like fiat currencies (e.g., USDT, USDC), commodities (e.g., PAXG for gold), or managed via algorithms (less common). They aim to minimize the volatility common in cryptocurrencies like Bitcoin, making them appealing for transactions.

How Stablecoins Work

Stablecoins maintain their peg through:

1. Fiat-Collateralized: Backed by fiat reserves (e.g., USDT tied to USD).

2. Commodity-Collateralized: Linked to assets like gold (e.g., PAXG).

3. Crypto-Collateralized: Backed by other cryptocurrencies.

4. Algorithmic: Supply and demand adjusted via algorithms (rare).

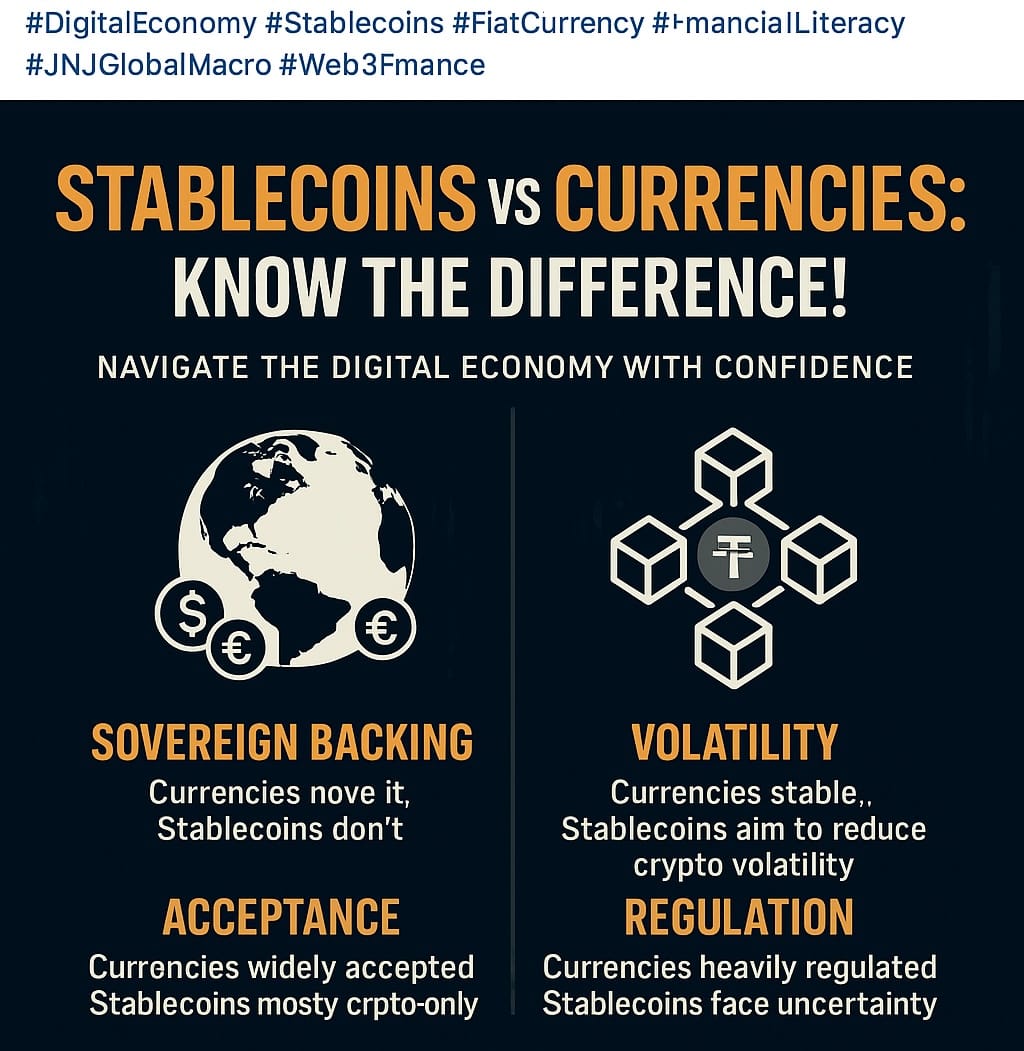

Key Differences

1. Sovereign Backing: Currencies are government-backed; stablecoins rely on private issuers.

2. Volatility: Currencies are generally stable; stablecoins aim to reduce crypto volatility.

3. Acceptance: Currencies are universally accepted; stablecoins are primarily used in crypto ecosystems.

4. Regulation: Currencies face strict oversight; stablecoins operate in a regulatory gray zone.

Risks of Confusing Stablecoins with Currencies

Mistaking stablecoins for currencies can expose investors to:

- Default Risk: Stablecoins lack sovereign backing, relying on issuer creditworthiness.

- Counterparty Risk: Issuer insolvency could render stablecoins worthless.

- Liquidity Risk: Converting stablecoins to cash may be challenging in volatile markets.

- Regulatory Risk: Evolving regulations could restrict stablecoin use.

- Fraud Risk: Some stablecoins may be tied to fraudulent schemes.

- Systemic Risk: Widespread stablecoin adoption could destabilize markets if failures occur.

Use Cases for Stablecoins

Stablecoins shine in decentralized finance (DeFi), cross-border payments, and crypto trading, offering low-cost, fast transactions without traditional banking intermediaries. However, their risks demand careful consideration.

Conclusion

Currencies are sovereign-backed pillars of stability, while stablecoins are innovative but riskier tools for the digital economy. For investors, understanding these distinctions is essential to make informed decisions in a rapidly changing financial landscape.

Call to Action

How are you navigating the rise of stablecoins? Share your insights or questions in our newsletter community, and explore trusted platforms to learn more about secure digital wallets and DeFi opportunities.